By Tadeus Dobrovolskij

Each company is unique and is dealing with its own set of challenges. Yet every company wants to grow. In our experience there are five most common obstacles that companies face to achieving the growth they desire: poor leadership, undefined strategy, unsuitable organization, operational chaos, and a lack of financial oversight. In this article we will take a look at these issues, potential solutions, and what benefits you can expect from them.

1. Poor Leadership

There is a reason why history books focus on influential kings, presidents and warlords. There is a reason why high-profile CEO’s earn as much as they do. Leadership does matter and the person (or, in some cases, persons) at the helm can easily sink even the most successful company – or turn around the failing business and take it to new heights.

Often the other four problems mentioned below stem from bad leadership practices. Therefore, it is crucial to ensure that the leadership is sound before dealing with other issues.

Many business books (especially the ones you will find in airports) will taunt you easy solutions to be a better leader: be authentic, don’t micromanage, empower. The reality is far more complicated. Leadership depends on context. It is a mistake to approach people from Egypt the same way as you approach Americans. Leading a nuclear power plant isn’t the same as leading a tech startup. Corporate turnaround requires different methods than a market expansion. The only factor that is common: leaders need to achieve results.

To achieve results, a great leader should be able to:

- Establish a clear vision. A good start is to answer the “How should the company look like in 10 years?” question.

- Develop a plan to achieve this vision. This usually requires an extensive analysis and a capable leadership team. For many companies this could mean that new people need to be hired first.

- Communicate both the vision and the plan effectively, i.e. in a way that creates a gut-level understanding and buy-in across the business. This means choosing the appropriate style for your personality and the context you are dealing with.

Execution comes afterwards. If the company has a vision with a plan, a capable leadership team that communicates well and is able to gain trust across all levels, execution will be a success.

Great leadership isn’t easy and many people fail. Yet the outcome for a business can be staggering: companies led by great leaders earn twice as much as companies led by good leaders (and bad leaders lose money).

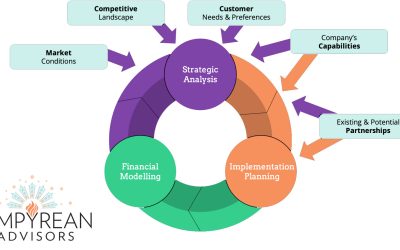

2. Undefined (or Ignored) Strategy

Strategy is one of the most popular topics in business literature, but it was associated purely with military just a century ago. Strategy is definitely related to leadership and is crucial for healthy growth.

Opportunistic companies are often too eager to dismiss a long-term vision and take any chance to sell. They thus incur unnecessary costs and waste precious time on ineffective sales channels. This problem can arise for both startups and established companies and it can lead to stagnation, or, even, decline.

Then there are also companies that have never developed a strategy and follow management’s instincts, which sometimes deliver results, but most often – do not.

Although it is common for a startup to experiment, pivot and change business models, it is expected that eventually the startup will settle on one idea that works, and develop a strategy to achieve the founder’s goals. In our experience this doesn’t always happen. Often startups get stuck with a product that seems to sell at the moment, but no one knows how to take it to the next level.

Mature companies, on the other hand, may have had a strategy in the past, but due to changes in the competitive landscape and customer behavior, the strategy became obsolete and no one follows it anymore. Or, which also happens, the leadership behind the original strategy left the company, and without the support from the top the strategy got forgotten.

Yet, if you want your company to grow – and not just survive – a good strategy (and unwavering support for it) is crucial. According to a study from Harvard Business School, which analyzed 160 companies over a ten-year period, organizations with a clearly defined strategy showed a 15 times greater (945% vs 62%) return to shareholders and 5 times higher advantage in sales (415% vs 83%) when compared to not-so-successful peers. Without a strategy, employees have no meaningful business objectives and resource distribution is suboptimal. This leads to inefficiencies, which accumulate over time.

Unless you are ready to forgo a clear competitive advantage, you need to ensure that your company has a strategy and that it is being followed when making decisions.

3. Unsuitable Organization

When companies develop and grow their structure often lags behind. This is a big challenge especially for companies which transition from small to medium, and from medium to large. Of course, big companies that have been in the market for many years could benefit from a smart restructuring as well (and often they do, eliminating waste), but in the aforementioned cases there is a significant need for a planned approach to organizational design.

The reason for this problem is simple: when a company outgrows itself, a person in charge can’t do his or her job effectively anymore. There is simply too much going on, and if the person does not delegate and create (or restructure) a certain hierarchy, decisions will be stuck, nothing will get done, people will get frustrated and stop caring – or leave.

However, in the modern, fast-paced world an additional level of hierarchy is often not the best solution (although it’s the most obvious choice). After all, it adds bureaucracy and bureaucracy can be as deadly to a business as a decision-making bottleneck. Ideally, you want to retain the short reaction time to market changes that is so common in startups and early stage companies. To achieve that, you can introduce agile work practices.

Agile became popular in the software development world in the early 2000s. It is based on cross-functional teams that introduce changes to the product often, measure customer response, and make adjustments, if necessary. Mark Zuckerberg, CEO of Facebook, described this approach in his famous quote “Move fast and break things. Unless you are breaking stuff, you are not moving fast enough.“.

Of course, you need to be smart about introducing agility into your company, but the good news is that agility doesn’t mean instability. As long as you keep your core processes standardized, and retain good governance practices, you could achieve 30% profitability growth and a 37% faster revenue increase.

4. Operational Chaos

Inconsistent quality, redundant work, and – as a result – poor customer satisfaction often plague companies in the growth phase. This is a normal part of a business evolution: the young company is concerned with creating a product and delivering it to the end consumer. Typically, there are no, or only limited, policies in place, and management is opportunistic. It can be a boon to a startup, but it will stifle the company’s growth eventually.

The challenge can be overcome by means of a planned approach to the company’s policy development, figuring out and writing down your goals and objectives, and introducing standardized, written processes company-wide. You can expect a lot of resistance, however, because many employees will consider it unnecessary bureaucracy at first. This is why it’s crucial to employ the best change management practices and have senior leadership’s support until the changes stick and become a part of your company’s DNA.

The effort is worth it though. Studies show that you can expect an up to 30% reduction in your operating costs and up to 20% improvement in quality. It can easily double or even triple a company’s value. Moreover, it helps in obtaining important process or quality certifications for the business (like ISO 9001) that will allow it to get more lucrative contracts and boost sales.

5. Lack of Financial Oversight

SME’s often disregard developing financial capabilities, because they either do not have enough money to spare to hire a CFO, or because they think that this is something that only big, public companies need to worry about.

However, the impact of good financial reporting and forecasting tools shouldn’t be disregarded. Not only will it simplify securing a loan or an investment, but it can be a matter of life and death for many growing companies – if a company doesn’t track its working capital, it can easily run out of cash and be forced into insolvency. This is very common for companies experiencing rapid growth.

Moreover, financial forecasting, which often goes hand-in-hand with the working capital management, helps to optimize resource usage and enables better decision making. Companies that excel in this area show on average a 12% faster share price increase over a 3 year period when compared to the rest (46% vs 34%). This gives you an opportunity to be valued 9% more in 3 years than the majority of your competitors.

Creating a tailored financial forecasting system is often one of the first initiatives we undertake for our clients, because of the impact it has on their performance.