By Tadeus Dobrovolskij

The pessimist complains about the wind. The optimist expects it to change. The leader adjusts the sails.

– John C. Maxwell

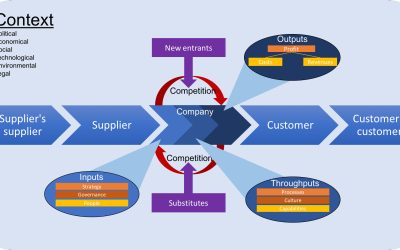

The financial crisis required an unprecedented intervention from central banks. The Fed, the ECB and other governing banks had launched a set of policies, which is known as quantitative easing (QE). In the year 2017 the Fed decided to end QE and unwind its balance sheets. Similar action is expected from the ECB in the near future considering the positive outlook for the eurozone economy. In this article, I would like to explore what this shift of policies will mean for businesses and what financial strategy CEO’s and CFO’s should pursue.

To start off, we need to understand what exactly QE is. Without going into too many details, QE can be defined as an expansionary monetary policy where a central bank buys low-risk securities (e.g. government bonds) on the secondary market. Thus, other market players get money, which they reinvest back into the economy by buying bonds and stocks. In this way the Fed boosted the US economy by $3.5 trillion and ended up in possession of $4.5 trillion worth of securities.

The Fed’s decision to end QE basically means that they will start selling those assets back to banks, pension funds, insurance companies and other market players. We can expect that it will decrease the money supply which will in turn increase interest rates.

The end of QE and the nearest future of financial markets were a major topic in Davos this year. In the short term, we shall see two effects:

- Higher interest rates – interest rate increases by the Fed will be compounded by the decrease of money in circulation due to unwinding of the Fed’s portfolio;

- Increased volatility – QE dampened market volatility, therefore, it’s only natural to expect reversing of this trend, similar to what happened this week. This will lead to higher risk premiums.

Both those factors affect the cost of capital as both debt and equity will become more expensive.

On the other hand, long-term effects are still under debate, considering that the economy is behaving strangely – inflation and unemployment are both at very low levels, contradicting what we know about Phillips curve, which describes an inverse relationship between inflation and unemployment. The last time similar anomaly happened was in the early 70’s, right before the recession of 1973-1975.

Recent US tax cuts will also increase the inflationary pressures on the economy. While there are strong sentiments on Wall Street in the wake of soaring stock prices and large trading multiples, the inflationary pressures will catch up to the economy and cause a downturn. As can be seen in the Davos video, the central bankers generally agree that the downturn is unlikely in the next 18 months, but they also agree that it will occur in the next 3 years.

To prepare your business and guard it against the future turbulences, I suggest the following:

- First of all, be conservative with debt – do not overleverage your business just because the economy is strong. Recession will enhance any existing debt pressure.

- Second, be cautious with mergers and acquisitions. M&A’s are still on the rise with a strong forecast for 2018 with a continuance of high trading multiples indicating a sellers’ market. The top two reasons for a failed acquisition are overpaying and overestimating the cash flows derived from synergies or other improvements. When the market slows down, the high price and low cash flows can impair both the acquisition and the acquirer. Be patient and wait for the market to cool.

- Finally, switch from a growth mindset to the profitability mindset. Cost cutting and a focus on efficiency will make your business more resilient. Make sure that your business model is sound, look inwards and invest in people.

Although the economic outlook can appear to be pessimistic, this definitely does not mean that you should stop developing your business. Have you been postponing culture change initiative? It could be a good time to start it now. Process improvements, software upgrades, new machinery – anything that could increase efficiency and prepare you for whatever comes next.

Macroeconomic forces can sweep over unprepared businesses, destroy dreams, and ruin investments but remember, business cycles come and go, it’s only natural. The key to success is preparation and leadership. Due to our work with clients across the globe, we are well positioned to help you navigate these challenges. If you would like to know more about how we can help, please inquire.